Government officials will NEVER ask you to transfer money or disclose bank log-in details over a phone call.

Call the 24/7 ScamShield Helpline at 1799 if you are unsure if something is a scam. For more information on how to protect yourself against scams, please visit the ScamShield website.

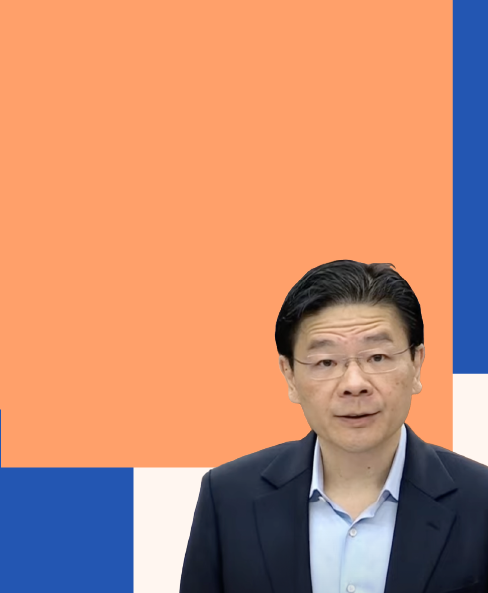

Budget 2025 Highlights

Support for Singaporeans

Support for You and Your Household

Support For You Calculator